Most Active Tech VCs in San Diego

Key facts on Correlation Ventures, Harpoon Ventures, Ankona Capital, and more

Business San Diego delivers in-depth profiles of founders and insights on the most successful companies, executives, and technologies in San Diego. Subscribe to make sure you don’t miss the next story.

In February 2023, we published our first installment of venture firms who have an active or growing presence in San Diego. Which included firms such as Section 32, Qualcomm Ventures, Moore Venture Partners, Avalon Ventures, Keshif Ventures, Social Leverage and Longley Capital.

While it was a top-five shared article last year, the list raised eyebrows among local investors who were not included on the list as well as founders who pitched some if not all of them, and failed to raise capital from local investors. Learn key details who, how much money, and the key deals driving past and future returns in San Diego.

The 2024 installment covers Correlation Ventures, Ankona Capital, Harpoon Ventures Interlock Capital, and Spark Growth Venture Partners. We also included key contacts at firms featuring NuFund Ventures Group, Symphonic Capital, Anzu Partners, Behind Genius Ventures, NextGen Venture Partners, plus several others who recently migrated to San Diego from other ecosystems.

Correlation Ventures

With offices in San Diego, San Francisco and New York, the firm is one of San Diego’s longest-standing local venture capital firms. It has invested in six local companies including Synthorx, MosaicML, Janux Therapeutics, Empyr, and Nerio Therapeutics.

Fund Size

Latest fund size: $130M (closed June 2023)

Total Investments made: 380

Local investments made: 6+

Key Contacts

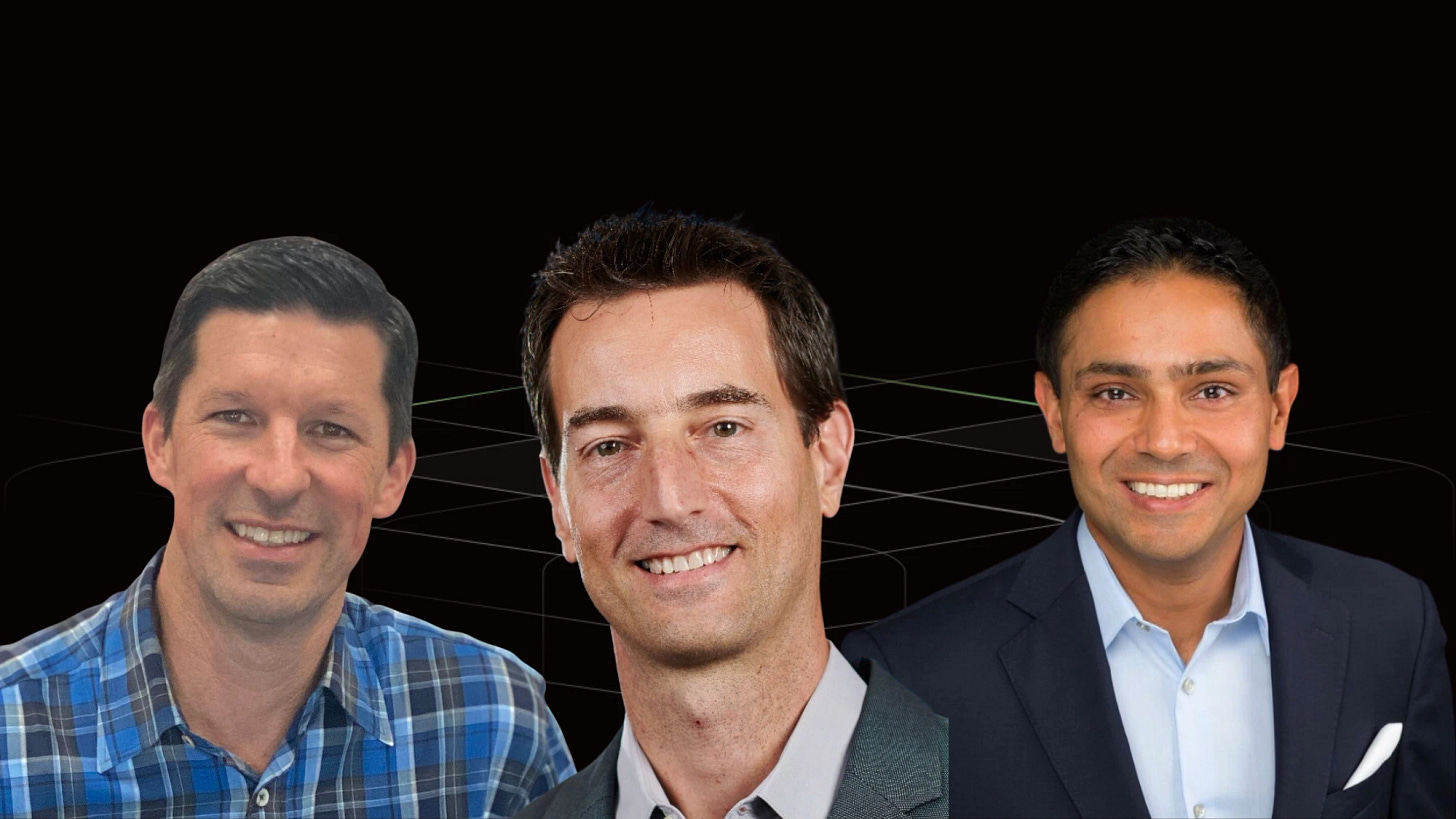

David Coats, co-founder and managing director.

Grace Chui-Miller, chief financial officer.

Notable Portfolio Company Exits

Synthorx: firm participated in the biotech startup’s Series A, B and C round before the company was acquired for $2.5 billion by Sanofi in 2019.

MosaicML: firm participated in the AI machine learning startup’s seed round before the company was acquired for $1.3 billion by Databricks.

Janux Therapeutics: firm participated in the startup Series A round, which inked a deal with Merck and reportedly has a $500 million market capitalization.

Ankona Capital

Based in Orange County, Ankona Capital has invested in a several of San Diego’s fast-growing tech startups and remains committed to backing promising technology companies in the area. It has invested in five local companies including Cordial, GoSite, Lawmatics, SOCi, and Zingle.

Fund Size

Latest fund size: $129M (closed October 2023)

Total Investments made: 21

Local investments made: 5

Key Contacts

Brian Mesic, managing director.

Notable Portfolio Company Exits

Zingle: the firm participated the B2B messaging platform company’s Series A round, which was acquired for $42 million by Medallia in 2019.

Harpoon Ventures

With offices in Menlo Park and San Diego, Harpoon Ventures is one of the few venture capital firms investing primarily in defense-technology companies. It has invested in more than 40 companies, the majority which are based outside of the area given its strong times to the Bay Area-based firms A16z and Lightspeed.

Fund Size

Latest fund size: $125 Million (closed December 2023)

Total Investments made: 40+

Local investments made: N/A

Key Contacts

Larsen Jensen, founder and general partner.

Rylie Loftus, early-stage investor.

Notable Portfolio Companies

Astranis: firm participated in the San Francisco-based satellite developer’s Series C round which had a $1.6 billion valuation in 2023.

Solugen: the firm participated in the Texas-based manufacturing bio-based solutions company’s Series B & C round, and is valued at more than $2 billion.

Interlock Capital

Based in San Diego, Interlock Capital is one of San Diego newest venture capital firms. The firm has a network of more than 1,200 experts which includes angel investors, subject matter experts, and operators to invest and grow startups.

Fund Size

Latest fund size: $10 - $50M (closed December 2023)

Total Investments made: 30

Local investments made: 10+

Key Contacts

Neal Bloom, co-founder and managing partner.

Al Bsharah, co-founder and managing parter.

Notable Portfolio Companies

Acquire.com: firm participated in the M&A marketplace startup’s seed round in 2023.

Mercato: firm participated in the grocery e-commerce startup Mercato Series A round.

Spark Growth Ventures

Based in San Diego, Spark Growth Ventures is a community-oriented venture capital firm. The firm has a network of 1,400 investors and has deployed nearly $40 million in capital over the last three years. Its portfolio includes San Diego-based startups Good Face Project, Seattle-based Humanly, among others.

Fund Size

Latest capital deployed: $44M

Total Investments made: 25

Local investments made: 8

Key Contacts

Hem Suri, founder and managing partner.

Notable Portfolio Companies

Good Face Project: firm participated in the San Diego-based chemistry informatics company’s seed round in 2022.

The San Diego VC Directory

Fund size: $200M (closed in September 2023)

Key contact: David Michael, co-founder and managing partner.

Fund Size: $63M (closed August 2023)

Key Contact: Jon Bassett, managing partner.

Fund Size: $10M+

Key Contact: Mike Krenn, founding managing partner.

Fund Size: $10M+

Key Contact: Sydney Paige Thomas, founding general partner.

Fund Size: $10 - $15M

Key Contact: Paige Finn Doherty, founding partner.

Fund Size: $10M+

Key Contact: Lolita Taub, founder and general partner.

Crescent Ridge Partners Ventures

Fund Size: $10M+

Key Contact: Allison Long Pettine, managing partner.

Key Contact: Maria Gonzalez-Blanch, partner.

Fund Size: $7M+

Key contact: Serhat Pala, president.