SCOOP: Top VC Firm Nabs Series C in San Diego Startup Mosaic

San Diego startup has raised $26 million in Series C funding led by OMERS Ventures.

Learn from San Diego's greatest entrepreneurs and companies. Every week, I write a newsletter breaking down the business and money in San Diego. Join hundreds of entrepreneurs and investors by subscribing below.

Founders,

Mosaic, a San Diego-based startup has raised $26 million from top venture capitalists.

Led by OMERS Ventures, the Series C funding will be used expand its features, offerings, including developing AI-powered solutions.

The investment comes at a time when late-stage dealmaking has slowed. The Del Mar-based company is one of the handful of technology firms that have raised growth funding this year, joining Measurabl, SOCi, and Fabric8labs.

Today, Mosaic has achieved a 3.5x increase in customer base, raised funding from top investors like General Catalyst and Founders Fund, and serves dozens of fastest-growing technology companies worldwide.

Please enjoy this overview of Mosaic.

High-Level Overview

Founded in 2019, Mosaic’s aims to transform the way companies make decisions using its “real-time planning and analytics” platform

The 4-year-old company’s platform can predict and forecast financials data with high accuracy, and speed.

What makes it special? The company has raised over $70 million from top Bay Area VC firms, while tripling it revenue growth each year since its founding.

Founding Story

In 2012, all three co-founders Bijan Moallemi, Joe Garafalo and Brian Campbell, spent time at Palantir Technologies, a publicly traded tech company.

During their time, they helped scale Palantir to 2,500 people and over $750 million in revenue in under 10 years.

The trio moved on to other senior finance roles at companies such as Piazza, Axoni and Everlaw before teaming back up to launch Mosaic in 2019.

“We started Mosaic because of our shared experience of implementing an incumbent FP&A software. It took us over six months to put that platform in place, and ongoing maintenance was a nightmare. Right now, we can get Mosaic customers up and running in four weeks,” said Joe Garafalo, co-founder and COO of Mosaic.

How Does it Work?

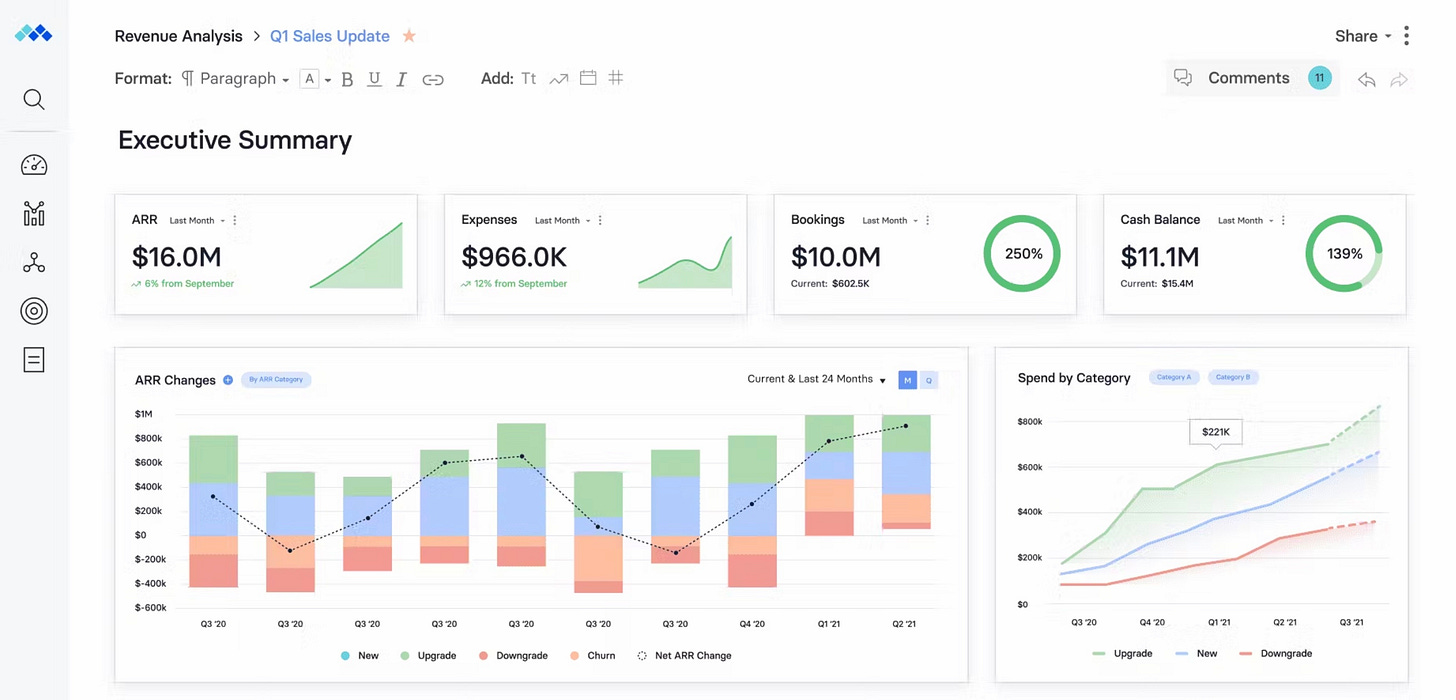

Mosaic software includes dashboards, modeling and data visualization tools geared toward financial planning use cases.

Its primarily for corporate finance departments within fast-growing organizations and allows users to quickly share insights with stakeholders.

Companies can gain a better sense of when to execute on their plans, it also integrates with existing tools teams are already using.

“Strategic finance is still trapped inside of Excel. Mosaic recognized that a shift to Google Sheets wasn’t going to drive the future of finance. We wanted to create a platform brings financial planning into the modern era,” Bijan Moallemi said co-founder and CEO of Mosaic.

Startup to Watch

Mosaic has grown its customer base by 300 percent year-over-year. Its annual recurring revenue (ARR) are in the “tens of millions”.

Notable customers include: Pipe, Kandi, Drata, Fivetran, Soucegraph and Crossbeam.

While there are several VC-backed competitors, such as Stargazr, Drivetrain, and Cube, Mosaic remains one of the primary leaders in the sector

Founders Fund, one of the lead investors in Mosaic, also made notable investments including Airbnb, Lyft, Facebook, Flexport, Palantir, SpaceX, Spotify, Stripe, Wish, Neuralink, and Twilio.

“Even the newest companies tend to inherit old and cumbersome finance tools to plan their growth. Mosaic saw this and fixed it, giving companies access to a Strategic Finance Platform that works as quickly and effectively as the best teams do,” Peter Thiel, billionaire technology investor, wrote in a statement.

Investors on Mosaic’s Cap Table

The Series C round brings the total amount raised by Mosaic to over $70 million.

Its valuation has not been disclosed, however this new investment round implies the company is worth more than $100 million-plus.

Investors are betting the startup will reach unicorn status ($1 billion valuation) within in the next decade. However, it still has some ways to go.

Venture capital firms invested include: OMERS Ventures, Founders Fund, General Catalyst, Friends and Family Capital, Fifth Down Capital, Felicis Ventures, Village Global and XYZ Ventures, among others.

“Companies that can raise a Series C in this environment need to showcase massive potential, which we saw in Mosaic,” said Eugene Lee, partner at OMERS Ventures. “In 2023, we’re on pace to see the lowest volume of Series C venture capital deals in years.”

Looking Ahead

As of today, Mosaic employs roughly 80 full-time employees, with a quarter working at its San Diego headquarters in Del Mar.

It plans to use the new capital to expand into new verticals and bring on additional enterprise customers.

It will be fascinating to see whether San Diego-based Mosaic follows the footsteps of Palantir Technologies, by hitting the public markets one day.

It is estimated, that Palantir’s IPO success yielded $1.8 billion-plus in capital returns for Founders Fund — a “home run” in the venture capital world.

“Any founder who raises VC money to grow their business has to understand one thing—that investors are looking for grand slams, not just home runs,” Bijan Moallemi, co-founder and chief executive at Mosaic, wrote in a blog post.

“At a seed stage or Series A, VCs are buying lottery tickets. They’re betting on your founding team and on your vision. Once you get to the Series B, Series C, and beyond, you have some certainty about which go-to-market investments will bear fruit,” he added.

Feedback helps improve SD Founders. How did you like this week's newsletter?