The San Diego Crypto Ecosystem

Entrepreneurs, Investors, and Experts Find Opportunity in the $12 billion-plus Industry.

San Diego is finally gaining recognition as a competitive startup city.

In 2021, more than $6 billion has been invested by venture capital firms into San Diego-based startups, a new record.

Although America’s finest city is not discussed in the same light as other major tech cities like Silicon Valley, San Diego is worth paying attention to as the tech community continues to thrive and more billion-dollar companies are created.

As the local tech ecosystem matures it may also signal an emergence for the cryptocurrency and blockchain sector.

For this story, I interviewed crypto-focused entrepreneurs, investors, and experts to better understand San Diego’s role in the cryptocurrency space.

$12 Billion and Growing

According to data pulled from Crunchbase, the cryptocurrency sector saw $12.1 billion invested globally in 2021, up from $3.7 billion last year.

Notable companies which received the largest amount of capital included Robinhood, FTX, CoinSmart, and Ledger which are considered unicorns — companies with a valuation of $1 billion.

Social Leverage, an investment firm with offices in San Diego, was an early investor in one of those unicorn companies. Howard Lindzon, who co-manages the firm, recalled he invested $100,000 out of its $6 million Social Leverage fund along with his partner Tom Peterson roughly eight years ago.

“I knew I’d be investing in Robinhood within 5 minutes of meeting the team. It was back in 2013, and Robinhood was just some screenshots and a vision. There was no SEC approval yet. I had a feeling the market was ready for a mobile-first, simple brokerage app. Today, Robinhood is the fast-growing financial app ever and has raised over $60 million,” wrote Lindzon in a blog post.

Today, Lindzon’s stake in the stock-trading company is worth somewhere in the neighborhood of $100 million-plus.

High-Profile Investors

Other high-profile investors entrenched in the cryptocurrency space include Chris Cantino, managing partner of Color Capital, and Vinny Lingham, a serial investor who relocated to San Diego in search of a better quality of life.

Both are extremely online, they have built cult-like followings on Twitter largely due to their original thoughts on the future of the crypto and promotion of decentralization.

Investing in Solana

Lingham, who co-founded a bitcoin-based startup called Civic, is best known for being an early investor in Solana Labs, which is valued at more than $41 billion, according to CoinGecko.

“The journey to working with Solana began several years ago,” recalled Lingham during an interview.

In particular, they met through a mutual friend that plays underwater hockey —back when Solana was looking for its seed round of funding— the connection eventually led to a check that help the company get off the ground.

Solana — which started as a San Diego-based blockchain startup before moving its headquarters to San Francisco —has quickly become one of the biggest crypto startup success stories and has raised capital from the world’s leading investors.

In June, the startup raised $314 million in funding led by Andreessen Horowitz and crypto hedge fund Polychain Capital. Lingham’s stake in the company has not been disclosed.

Building in Solana Beach

Launched by former Qualcomm engineers, the company’s name was coined after Solana Beach, where the co-founders would regularly surf during their free time.

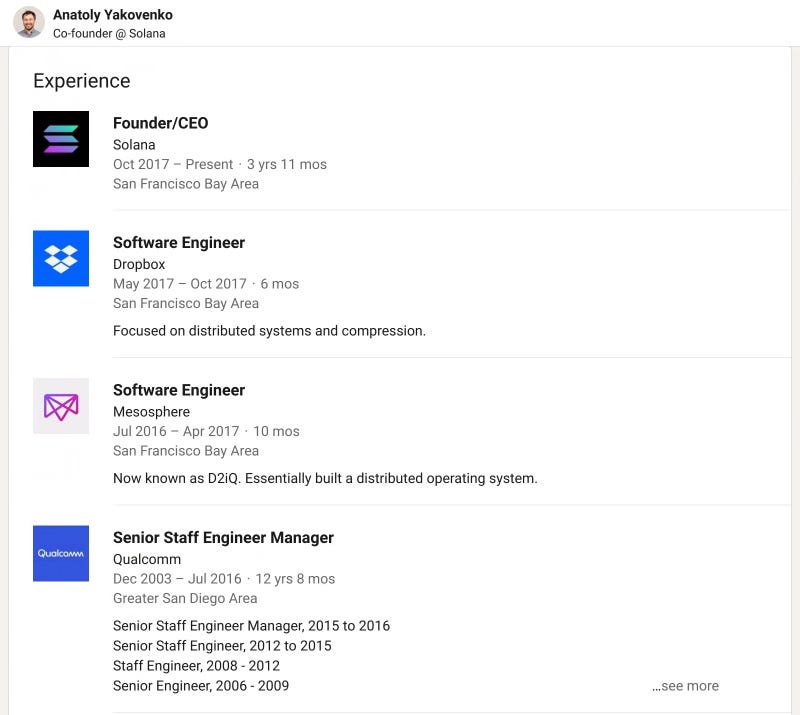

Solana’s CEO Anatoly Yakovenko spent more than a dozen years as an engineer working on wireless protocols at Qualcomm before departing in 2016. He worked on wireless technology, which allows several transmitters to send information simultaneously over a single communications channel.

Today, Yakovenko has assembled a distributed team of 50+ employees, including numerous Qualcomm colleagues.

Solana is an Ethereum competitor. This year, activity on the Solana network has exploded this year on the back of two trends that rely upon it: NFTs (nonfungible tokens), and “DeFi,” short for decentralized finance.

The price of Sol, the in-house currency on the network, has jumped from about $10 earlier this year to nearly $200, to date.

San Diego is home to a handful of crypto-focused companies, blockchain startups and investment firms, to name a few:

+ many others.

Bitcoin MeetUps

Paul Puey, founder and chief executive of Edge Wallet, has been quietly bringing the crypto community together for nearly a decade.

Puey is best known for hosting monthly Bitcoin meetups, where crypto luminaries have the opportunity to present their projects and recruit talent for their companies.

The group has nearly 2,000 community members across San Diego county. The event typically attracts up to 100 attendees and is hosted at Edge’s headquarters in Downtown San Diego, Little Italy.

Previous guest speakers featured Emilio Cazares, chief legal officer of SuperRare, which is a popular marketplace for buying and selling digital art as NFTs, as well as Charlie Silver, founder of Permission.io, who has successfully exited five startups throughout his career.

Grant Creighton, a crypto expert who has attended several Bitcoin meetups in San Diego, noted that the local community continues to grow and is helpful for people who are interested in getting involved in crypto.

“San Diego has a growing crypto scene, however, it can be fairly limited. Getting to connect with the real ‘OG’ crypto people within San Diego can be a challenge. The events brings together a really smart community, everyone’s super friendly. It can take many years of knowledge to gain a deeper understanding of everything that’s happening in crypto today,” said Creighton during a phone interview.

The next meetup will take place on Oct. 19.

Building in San Diego

Andreas Freund, a technology advisor who specializes in emerging IoT, blockchain scaling, and other crypto applications, noted that very few game-changing solutions are being launched in the San Diego market today.

Freund also noted San Diego may find opportunities in the Cannabis industry as they need more blockchain-based solutions as well as better access to capital.

“San Diego is primarily focused on biotech and medical device companies. It also is by default one of the leading centers of the cannabis industry in California from an incorporated companies standpoint. I think the cannabis industry will start adopting blockchain solutions, especially because it allows them to get financing that they can get through traditional banks,” said Freund during a phone interview.

Chris Groshong, founder and president of CoinStructive, agreed San Diego lacks a competitive FinTech ecosystem compared to other major tech cities.

“San Diego is a great testbed, specifically for the entertainment and retail industry. They typically launched their concerts and tours in San Diego first. If a business model can gain traction in San Diego — it’ll probably work anywhere in the United States. It’s a difficult market,” said Groshong during a phone interview.

However, as more investors continue to relocate and invest in promising ideas — the overall crypto community will improve.

How did you like this month’s newsletter? Your feedback helps me make this great.

Shoot me a note — fredmgrier@gmail.com

Thanks for reading and see you next month!

Fred